Grover Jewells Limited IPO opens February 4th 2026 aims to fund working capital and growth plans

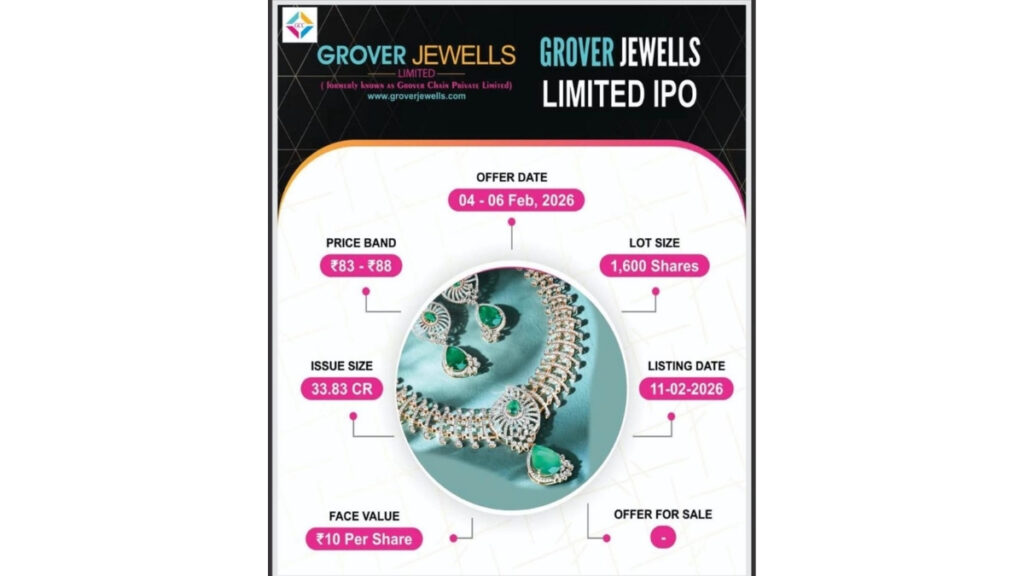

New Delhi [India], February 05: Grover Jewells Limited, a Delhi-based gold jewellery manufacturer and wholesaler, is set to open its Initial Public Offering (IPO) on the NSE Emerge platform from February 4 to February 6, 2026, with a price band of ₹83–₹88 per share. The company plans to raise ₹33.83 crore through the issue, as it looks to strengthen its working capital cycle and support corporate expansion.

According to the company’s investor presentation, Grover Jewells operates a fully integrated manufacturing setup in Delhi and caters largely to the wholesale (B2B) segment, while also taking steps to increase its retail (B2C) presence. The issue is expected to be closely watched by SME-market investors, particularly given the strong momentum in India’s organised jewellery sector and the growing shift toward branded, quality-assured products.

IPO details: price band, issue size, and listing schedule

Grover Jewells’ IPO is a 100% book-built issue, with the issue size at ₹3,383.42 lakh (approximately ₹33.83 crore), comprising 38,44,800 equity shares at the upper price of ₹88. The face value of each equity share is ₹10.

The company has proposed listing on the NSE Emerge platform, with the listing date set for February 11, 2026. The IPO includes allocation for Qualified Institutional Buyers (QIB), Non-Institutional Investors (NII), retail investors, and a market maker portion, as is standard for SME public offerings.

As per the issue schedule, the anchor bid opens on February 3, 2026, followed by the public subscription window from February 4 to February 6.

Business model: wholesale manufacturing with expanding portfolio

Grover Jewells Limited specialises in manufacturing and designing wholesale gold jewellery across a wide range of product categories. The company’s portfolio includes plain gold jewellery, studded jewellery, and semi-finished jewellery, primarily in 22 karat, 20 karat, and 18 karat formats.

The company initially built its core strength in gold chain manufacturing, but over the years expanded into bangles, rings, necklaces, and complete jewellery sets, aiming to serve diverse customer preferences and price points.

Grover Jewells runs an in-house jewellery manufacturing facility located at Lawrence Road Industrial Area, Delhi, with a built-up area of 1,003.20 sq. metres, equipped with modern machinery including casting machines, induction melters, steamers, and air compressors. A dedicated CAD design team supports product development, helping the company bring new designs to market regularly.

Retail footprint: showrooms in key Delhi jewellery markets

While the company’s primary focus remains B2B, it has a visible retail presence through two showrooms located in major jewellery trading hubs of the capital:

-

Karol Bagh, New Delhi

-

Chandni Chowk, Delhi

These locations are known for high jewellery footfall and wholesale-retail activity, allowing the company to serve both business buyers and end customers.

Growth journey: from small workshop to ₹450 crore turnover

Grover Jewells traces its origin to 2010, when promoter Deepak Kumar Grover began operations as a proprietorship under the name “Grover Chain Company,” reportedly starting with two machines in a small workshop.

The company’s investor note highlights that turnover grew steadily over the years, reaching ₹20 crore by 2017. A major leap came in 2018 with the adoption of Italian machinery and production technology, after which turnover reached ₹51 crore in FY2018–19.

In 2021, Grover Chain Private Limited was incorporated and subsequently acquired the earlier proprietorship business, enabling scale-up in operations. By March 31, 2025, the company reported turnover of over ₹450 crore, reflecting a sharp rise in scale in a relatively short time frame.

Financial performance: revenue growth and improving profitability

The company’s restated financials indicate consistent growth in scale. Revenue from operations stood at:

-

₹25,509.77 lakh in FY2022–23

-

₹25,791.13 lakh in FY2023–24

-

₹46,080.29 lakh in FY2024–25

Profit after tax (PAT) for the same periods was:

-

₹270.52 lakh in FY2022–23

-

₹278.05 lakh in FY2023–24

-

₹762.28 lakh in FY2024–25

For the provisional period ended October 31, 2025, revenue from operations was reported at ₹47,318.71 lakh, with PAT of ₹1,045.23 lakh, suggesting continued momentum.

The company’s PAT margin for FY2024–25 stood at 1.65%, while EBITDA margin was reported at 2.44%, reflecting the typically thin margins of high-volume bullion and jewellery manufacturing businesses, where scale, inventory management, and working capital efficiency are critical.

Why working capital matters in jewellery businesses

Jewellery manufacturing is highly working-capital intensive due to the nature of gold procurement, inventory holding, and credit cycles with distributors and retailers. For manufacturers, maintaining consistent production and supply often requires strong liquidity support.

Grover Jewells has stated that the primary objective of the IPO is to meet working capital requirements, along with general corporate expenses and issue-related expenses. Investors will track how effectively the company uses fresh capital to manage inventory, strengthen receivable cycles, and expand distribution reach.

Promoters and leadership team

The company is promoted by:

-

Deepak Kumar Grover (Managing Director)

-

Lavkesh Kumar Grover (Executive Director)

-

Bhawna Grover (Non-Executive Director)

The management team also includes independent directors and key managerial personnel such as the CEO, CFO, and Company Secretary & Compliance Officer, which is an important factor for governance in listed entities.

Post-issue, promoter shareholding is expected to reduce from 100% to approximately 73.5%, with the public holding about 26.5%.

Industry backdrop: India’s jewellery exports and domestic demand

India’s gems and jewellery industry remains one of the country’s most significant sectors, contributing strongly to exports and employment. The sector benefits from India’s established manufacturing ecosystem, skilled workforce, and global relevance in diamond processing and gold jewellery craftsmanship.

The company’s investor note mentions that the industry contributes significantly to GDP and exports, with the government also focusing on export promotion, MSME support, and initiatives such as hallmarking and policy support for trade competitiveness.

In recent years, demand for hallmarking, transparency, and quality assurance has strengthened the shift toward organised players-creating opportunities for manufacturers with strong supply networks, in-house capabilities, and scalable operations.

Outlook: a growth-focused SME listing on NSE Emerge

Grover Jewells’ IPO comes at a time when India’s SME capital markets have seen rising investor participation, especially in manufacturing and consumer-facing businesses. With its established manufacturing base, expanding product portfolio, and presence in key Delhi jewellery markets, the company is positioning itself for the next phase of growth through stronger capital support.

Market participants will closely watch subscription levels, listing performance, and post-IPO execution-particularly the company’s ability to strengthen its working capital position, scale operations efficiently, and gradually expand into the retail segment while maintaining profitability.